Tips and Strategies To Find Affordable Homes in 2023

With the soaring cost of housing today, it can be difficult to imagine affording a home in 2023. Fortunately, many budget-friendly options exist that can make the process reachable. It is important to consider all of your available resources, such as grants, loans, and other assistance programs that are aimed at families who are working effortlessly to become homeowners.

Additionally, choosing more affordable areas to live in or purchasing an older home that may require some repairs can also help reduce the price tag. With some creative planning and wise economic decisions, owning a home in 2023 doesn't have to feel like an impossibility.

What Has Caused Home Prices to Increase?

Housing prices have increased drastically over the years, largely due to economic factors such as a low unemployment rate, increasing wages, and rising demand for homes. When unemployment rates are low, people have more money to spend, and the demand for homes increases.

This leads to competition among buyers and bids that exceed asking prices. In addition, the development of new homes can also be a factor in rising prices, as there is often a limited supply.

By following the tips listed below, you can feel confident that you will be able to afford a home in 2023.

Tips for Affording a Home in 2023

Consider Alternative Financing Options

Many people overlook alternative financing options, such as grants and loans, that could help make the process of buying a home much more affordable. Grants are available through both state and federal programs, as well as local non-profits and organizations.

Research all of your options to determine which type would be the most beneficial for you. These programs are not just for first-time home buyers, so don't be afraid to look into them.

Research Smaller Markets

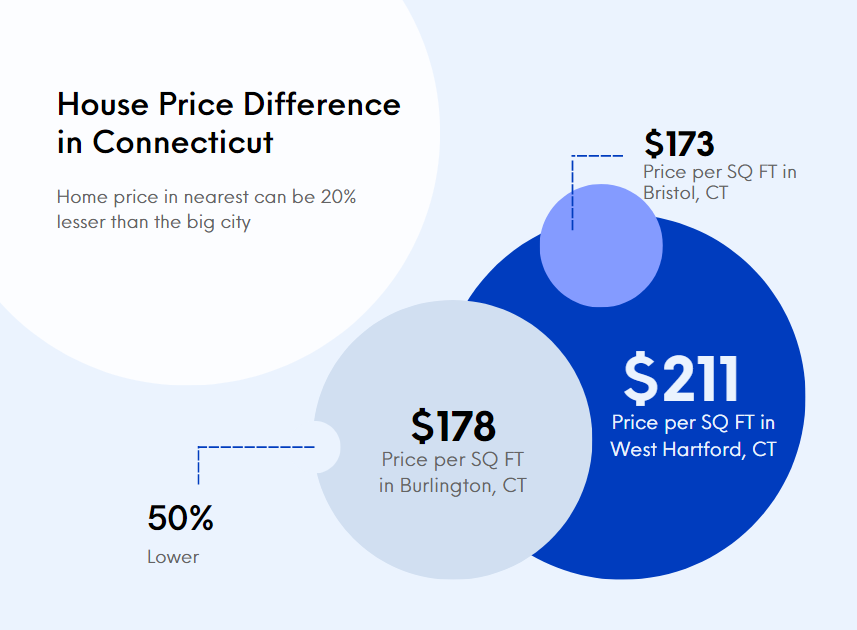

Home prices in different locations close to Boston

Don't overlook smaller markets or towns close to major cities. Big city living often comes with a steep price tag, and housing costs can be a major deterrent for many would-be homeowners. But by exploring nearby towns and suburbs, you may be able to find a home that fits your budget without sacrificing space or location.

For instance, finding homes for sale in California that fit your budget may seem like an impossible feat, however if you're willing to travel just an hour outside of the major cities you can see drops as high as 40-45% in home prices.

For instance, in West Hartford, CT, a single-family median listing price/sq ft is $211, but just a short drive away in Burlington, you can find a comparable home for just $178/sq ft.

Shop Around for Mortgage Rates

It is important to shop around and compare mortgage rates from different lenders before committing to one. Different lenders offer different rates, so it is important to shop around and find the best deal.

Additionally, consider whether or not you would be eligible for any government programs that can help with purchasing a home, such as FHA loans or VA loans.

Save Money Now

Start saving money now by reducing your expenses and cutting back on luxury items.

Start putting aside a portion of your income every month so that you can build up a sizable down payment. This will help lower your monthly mortgage payments and make it easier to afford the home when you eventually go to purchase it.

Some of the most efficient ways to save quickly include:

Eliminating unnecessary expenses

Creating a budget and sticking to it

Paying off any existing debt

Following an investment strategy

Taking advantage of tax breaks

Ask For a Cash Gift

If you have family or friends who are willing to help, consider asking them for a cash gift that would go towards the down payment on your home. This could be an effective way to reduce the amount you need to borrow and lower your monthly payments.

Many people find this option hard to discuss, but it can be a great way to make homeownership more affordable. It may also help to reduce the amount of interest you pay over the lifetime of your loan, saving you money in the long run.

Work on Your Credit Score

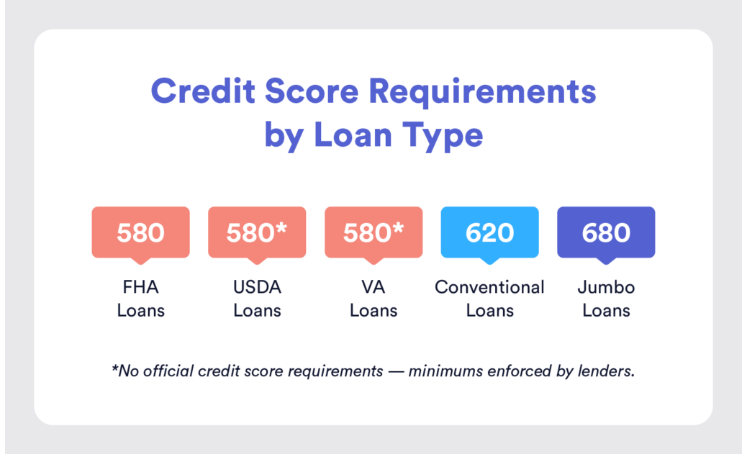

Your credit score is one of the most important factors when it comes to obtaining a loan, so make sure that you are doing everything you can to boost your score.

Paying off debt, using credit cards responsibly, and monitoring your credit report for any errors can help increase your score and make it easier to get a better interest rate on a loan.

Things you can do to maintain an impressive credit score include:

Making sure to pay all of your bills on time

Limiting the amount of credit you use

Avoiding late payments

Checking your credit report regularly for errors

Be Open to Compromise

While you should never have to settle for less than what you want, it is important to be open to compromise when purchasing a home. This means being willing to forgo certain amenities or features to stay within your budget.

Whether it's skipping out on a pool or opting for fewer bedrooms, making these compromises can help you get the house of your dreams without breaking the bank.

Wrapping Up

Ultimately homeownership and the path to getting there is different for everyone. Consider your budget, credit score, and lifestyle when determining what type of home you can afford and what steps you need to take to get there.

With careful planning and research, you can make your dream of owning a home a reality.